APRIL 6 2022

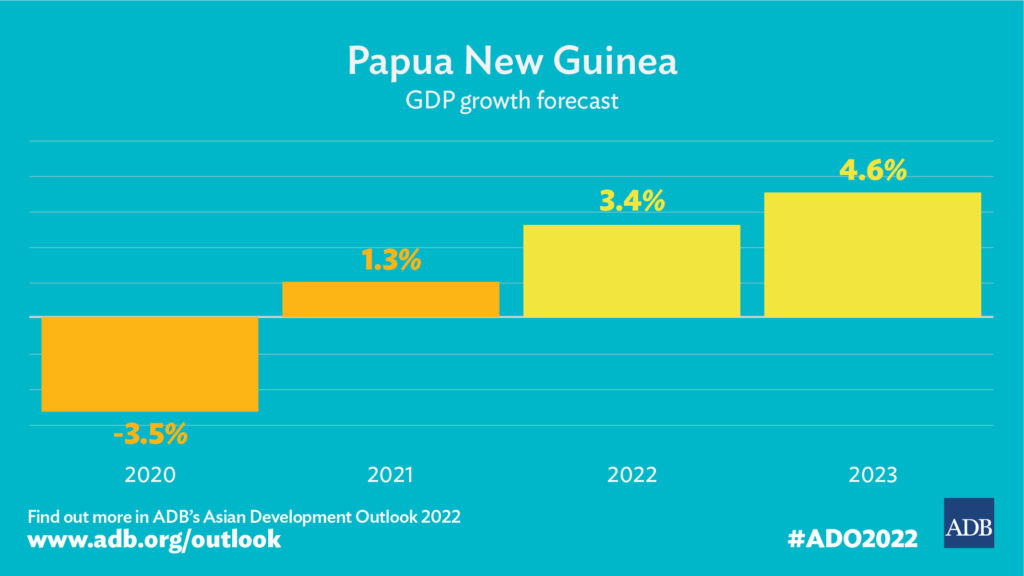

Economic growth in Papua New Guinea is expected to accelerate steadily to 3.4% in 2022 and 4.6% in 2023 as activity in mineral extraction picks up and more normal global economic conditions return, according to the Asian Development Bank’s Asian Development Outlook 2022 (ADO) released today (April 6 2022).

“The Porgera gold mine, which contributed about 28% of the country’s annual gold production before it closed, is expected to reopen in the second half of 2022 and ramp up production only later,” the ADO said.

“Its effect on GDP will therefore be greater in 2023 than in 2022.

“Papua LNG, a long-awaited liquefied natural gas project, is expected to proceed to its front-end engineering and design phase in the middle of 2022, but project expenditure within PNG during this first phase may not be large.

“A final investment decision should be made in the second half of 2023, when construction is expected to commence.

“Several other large resource projects are on the horizon.

“The P’nyang gas field project is a multibillion-dollar investment, as is the Wafi Golpu gold and copper mine, but its timing remains uncertain.”

The ADO said from the outset of 2022, however, the economy had been weighed down by the Omicron variant of COVID-19, which appeared in PNG in January.

“If experience elsewhere is a guide, its effects should dissipate fairly quickly, allowing a return to more normal conditions from sometime in the second quarter,” it said,

“In February, the PNG authorities ended quarantine requirements for incoming travelers who are fully vaccinated.

“Uptake of COVID-19 vaccines in PNG is unlikely to improve significantly in 2022, so the vast majority of the population will remain unvaccinated. These conditions could discourage overseas arrivals, but commercial investors are unlikely to be deterred as they are already used to dealing with many challenges in PNG.”

The ADO said the 2022 elections would see significant expenditure.

“National and local government elections are scheduled for the middle of 2022,” it said.

“Significant expenditure will accompany the election period as spending is ramped

up in provinces to improve services and infrastructure and as aspiring candidates fork out on rallies and other events to win votes.

“The government has pledged an additional K600 million for the election to cover security arrangements, logistics, and polling. Providers of accommodation and food services and of transportation services are expected to benefit.”

The ADO said inflation was expected to gather pace in 2022 as the Russian invasion of Ukraine pushed up commodity and in particular oil prices.

“Inflation should moderate in 2023 as commodity prices cool and global economic conditions normalise,” it said.

“The current account surplus is forecast to widen to the equivalent of 26.5% of GDP in 2022, driven up by rising commodity prices and reopening of the Porgera mine.

“Then it is seen narrowing somewhat to 22.1% in 2023 as import volume picks up to supply increased investment and as, geopolitical events permitting, commodity prices cool.”

The ADO said the 2022 national budget forecasted a fiscal deficit equal to 5.9% of GDP in 2022 and 4.4% in 2023.

“Raising sufficient revenue and other financing to execute the budget in 2022 will be a challenge,” it said.

“Revenue should, however, find support in higher oil and gas prices, particularly taxes and dividends paid by the PNG LNG project.

“The Department of Treasury forecasts that accumulated national debt will rise to equal 51.9% of GDP in 2022 and 52.5% in 2023.”

***